Tuesday 31 July 2012

Solo Oil PLC Advance Ruvuma Testing

Solo recently reported it has accessed £363,000 from their three year £10 million Equity Line Facility with Dutchess Opportunity Cayman Fund Ltd to continue funding the developments and current flow testing programme at the Ntorya-1 discovery well in Tanzania. Solo holds a 25% working interest in the Ruvuma PSA.

Solo has issued and allotted 90,844,685 new Ordinary Shares of 0.01 p each at a price of 0.40p pursuant to the drawdown. An Application will be made for the new ordinary shares to be admitted to trading on the AIM Market. The new ordinary shares will rank pari passu with the existing ordinary shares in the Company and trading of these shares on AIM is expected to commence on the 1 August 2012.

Following Admission, the Company's issued share capital will consist of 2,778,344,708 Ordinary Shares with a nominal value of 0.01p each, with voting rights ("Ordinary Shares"), and 265,324,634 deferred shares of 0.69p each. The deferred shares are non-voting, are not admitted to trading on AIM and are not entitled to any participation in the profits or the assets of the Company. The Company does not hold any Ordinary Shares in Treasury. Therefore the total number of Ordinary Shares in the Company with voting rights is 2,778,344,708.

The above figure of 2,778,344,708 Ordinary Shares may be used by shareholders in the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the share capital of the Company under the Financial Service Authority's Disclosure and Transparency Rules.

Strategic Minerals AIM:SML Set to Shine on AIM

Strategic Minerals AIM:SML the large scale processor of the magnetite bearing Cobre Stockpiles, located in New Mexico USA, edge closer to the commencement of mass tonnage shipment. With AIM mining stocks bearing the brunt of a negative market sentiment, there remain a few shining star stocks that offer shareholders some real earning and share performance upside. SML is one we pick out, principally because as Q4 approaches, Strategic are set to unveil an Olympic set of earning results courtesy of the fact they will be shipping up to 70,000 tonnes per month of magnetite under the terms of an offtake deal with Glencore. With investor appetite to fund exploration stage miners, SML are set to shine out as a transformation stock in 2013.

Keep an eye out for the guys!!!!

Keep an eye out for the guys!!!!

Monday 30 July 2012

Atlantic Coal AIM:ATC Olympic Production Performance Q2 2012

Atlantic Coal AIM:ATC, Q2 2012 production figures from their Stockton Anthracite Colliery USA, demonstrate clearly that ATC's management has been consistent in their assessment of Stockton's performance capability. Having suffered years of difficult mining conditions, ATC are now free of the railroad ingress, that caused so much to hinder the stripping and mining at Stockton.

With Stockton and ATC, "Now on Track" these latest production figures affirm the fact ATC is set to enter an unprecedented period of profitability.

See Below

Atlantic Coal plc ("Atlantic" or the "Company")

Quarterly Production Update

Atlantic Coal plc, the AIM-listed opencast coal production and processing company with activities in Pennsylvania, USA, is pleased to announce a positive production update from the Stockton Colliery ("Stockton"), its opencast anthracite operation, for the three months ended 30 June 2012.

Highlights

· 18.8% increase in clean coal production compared to Q1 2012 due to successful diversion of Norfolk Southern Railroad

· 57.7% increase in removal of bank cubic yards and 3% increase in run-of-mine coal washed

· Average sales price realised was US$166.85 due to continued strong demand for high quality anthracite

· The Board anticipates production to increase further and is targeting production of more than 155,000 tons for 2012

Atlantic Managing Director Steve Best said, "The successful diversion of the railroad in April has transformed our production profile at Stockton, and I am pleased to report that this is reflected in our increased quarter on quarter results. I am confident that this production increase will accelerate further over the coming months as we focus our attention on reserves contained within the prime Mammoth Seam. The Company equalled its total 2011 ROM production of 208,730 tons in July 2012.

"Additionally, it is important to note that, unlike recent trends in the thermal coal sector, we continue to experience solid demand for our high quality product. This creates a positive pricing environment in which to implement our growth strategy to consolidate our position in the productive Pennsylvanian anthracite field."

Detailed Information

Production increased 18.8% to 37,686 tons of clean coal during Q2 2012 compared to output achieved in the previous quarter (Q1 2012: 31,729 tons). During the period, Atlantic removed 1,128,981 bank cubic yards ("BCY") of overburden (Q1 2012: 715,691 BCY). 88,762 tons of run-of-mine ("ROM") coal were washed (Q1 2012: 85,911 tons). Demand for Stockton's high quality anthracite remains strong and, in line with this, the Company achieved an average sales price of US$166.85 for its Pennsylvanian anthracite (Q1 2012: US$166.30), excluding by-product #5.

The successful completion of the Norfolk Southern Railroad diversion in April 2012 has enabled Atlantic to access approximately 1.0 million tons of previously unworkable reserves and to achieve improved efficiency. The Company is confident that production will continue to increase incrementally during the remainder of 2012 and is targeting clean coal production of more than 155,000 tons for the year to 31 December 2012. This target is in line with an independent mining report produced by Mine Engineers Inc, which predicted that production of 160,000 tons of clean coal is achievable for the year.

Q2 2012 Production Summary:

| ||||||||||

Monday 2 July 2012

Solo Oil (SOLO.LN) Massive Discovery at Ruvuma PSA Tanzania Now Conformed via Independent Consultants

Tanzania: Solo Oil announces independent evaluation of the hydrocarbon potential of the Ruvuma PSA

02 Jul 2012

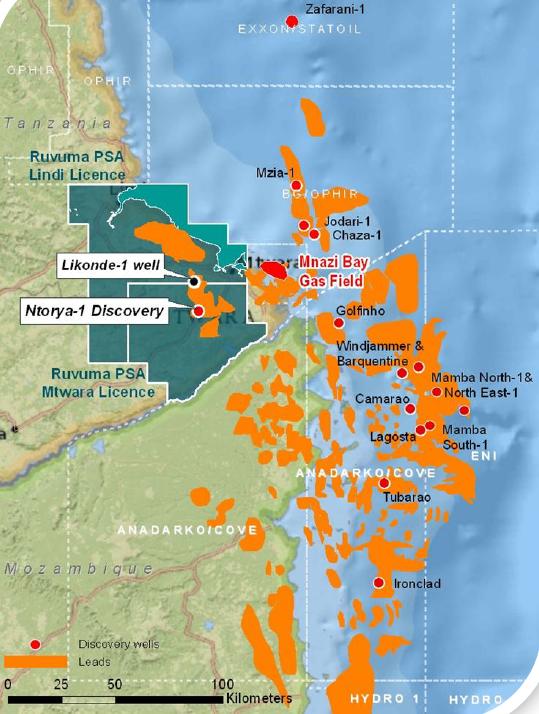

Ruvuma PSA (Source: Aminex)

Solo Oil has announced the results of an independent technical evaluation of the resource potential of the Ruvuma Basin onshore in southern Tanzania. The independent evaluation indicates 5.75 TCF potential. A technical evaluation of the Ruvuma PSA (operated by Aminex) has been prepared by ISIS Petroleum Consultants (ISIS) in Perth, Australia in which ISIS have attributed a total mean unrisked gas-initially-in-place (GIIP) for identified leads, prospects and discoveries of 5.75 trillion cubic feet (tcf).

Highlights

Highlights

- Mean unrisked GIIP within identified leads, prospects and discoveries of 5.75 tcf

- A total 1.17 tcf mean unrisked GIIP at Ntorya of which 178 billion cubic feet (bcf) is discovered

- A large lead up-dip of Ntorya is seen to have a mean 2.62 tcf unrisked GIIP potential

- ISIS also recognises significant, but so far unquantified, oil potential in the Karoo Formation

This is the first independent evaluation of the hydrocarbon potential of the Ruvuma PSA and the results serve to highlight the outstanding potential of this under-explored onshore and near-shore portion of the Ruvuma Basin, a basin which has recently been highly successful in the deepwater offshore in both Tanzania and Mozambique.

On 27 June 2012, Solo announced the results of flow testing of the Ntorya-1 discovery well with a final flow of 20.1 million standard cubic feet per day of gas and an estimated 140 barrels per day of condensate from good quality Lower Cretaceous sands. Based on the reservoir data from the well combined with seismic mapping, ISIS has calculated a mean discovered GIIP of 178 bcf, with a P10 upside of 284 bcf at Ntorya. Taking into account up-dip potential for the Ntorya Prospect defined by ISIS on seismic mapping, a further undiscovered mean GIIP of 990 bcf is estimated. The Ntorya sands are interpreted from seismic to be part of a marine channel fill sequence.

Further up-dip to the west of Ntorya, a separate channel fill complex, the Namisange Lead, has been identified from seismic, with a potential unrisked undiscovered mean GIIP of 2.62 tcf. A seismic infill programme is planned for later in 2012 to better image the Ntorya area together with the Namisange Lead. Appraisal drilling is expected to follow the completion of the additional 2D seismic data.

To the north of Ntorya, in the area of the Likonde-1 well drilled in 2010, the mapping has identified remaining up-dip stratigraphic potential in the excellent Lower Tertiary sandstone reservoir penetrated in that well, with a mean unrisked undiscovered GIIP of 504 bcf.

To the north of Ntorya, in the area of the Likonde-1 well drilled in 2010, the mapping has identified remaining up-dip stratigraphic potential in the excellent Lower Tertiary sandstone reservoir penetrated in that well, with a mean unrisked undiscovered GIIP of 504 bcf.

Further north and adjacent to the coast, the previously identified Sudi Lead has been re-mapped as a large Base Tertiary channel fill system with mean unrisked undiscovered GIIP of 436 bcf. Both the Likonde Up-dip and Sudi Leads require additional seismic in order to mature as drillable prospects. A number of additional leads have also been mapped in the onshore Ruvuma PSA, two to the west of Sudi and two on the eastern side of the block.

Although not yet quantified due to lack of seismic control, the ISIS report also recognises additional potential in the Karoo section, especially in the north of the Ruvuma PSA. Traps present in the Karoo have potential for oil, demonstrated by the oil-prone nature of the Karoo section in the Lukeledi-1 well drilled nearby in 1992, and the shows in Likonde-1.

In addition to the onshore discovery, prospects and leads, re-mapping of the offshore portion of the Ruvuma PSA (approx. 20% by area) has highlighted a major channel fill complex, named Kiswa, at the Base Tertiary Unconformity level to which ISIS have attributed unrisked undiscovered mean GIIP of 709 bcf.

Although not yet quantified due to lack of seismic control, the ISIS report also recognises additional potential in the Karoo section, especially in the north of the Ruvuma PSA. Traps present in the Karoo have potential for oil, demonstrated by the oil-prone nature of the Karoo section in the Lukeledi-1 well drilled nearby in 1992, and the shows in Likonde-1.

In addition to the onshore discovery, prospects and leads, re-mapping of the offshore portion of the Ruvuma PSA (approx. 20% by area) has highlighted a major channel fill complex, named Kiswa, at the Base Tertiary Unconformity level to which ISIS have attributed unrisked undiscovered mean GIIP of 709 bcf.

It is now intended to carry out a further 2D seismic acquisition programme in order to appraise the Ntorya-1 discovery and to upgrade the highest potential leads to drillable status. A minimum of two further exploration wells are planned for the Ruvuma PSA in the current exploration phase. Additional data will be targeted at refining the resource estimates and preparing for the next phase of drilling within the PSA.

Participants in the Ruvuma PSA are: Ndovu Resources (Aminex) 75% (operator) and Solo Oil 25%.

Participants in the Ruvuma PSA are: Ndovu Resources (Aminex) 75% (operator) and Solo Oil 25%.

Neil Ritson, Solo Executive Director, commented;

'The existence of identified discoveries, leads and prospects with mean potential of 5.75 tcf and a further significant potential for oil underlines the enormous potential of the Ruvuma PSA. When taken together with the vast reserves discovered to date offshore and the favourable operating cost environment of the onshore this represents a very valuable resource. Existing nearby infrastructure and the planned Mtwara to Dar es Salaam pipeline further enhance the commercial value of this acreage.

On the basis of the recent gas flow test results at Ntorya-1 and the over 1 tcf potential at Ntorya and the other prospects reported by ISIS; Solo will now be actively seeking an additional partner to participate in the next phase of exploration and development in the PSA. This is a very exciting time for Solo and we expect to have further positive news through the summer.'

'The existence of identified discoveries, leads and prospects with mean potential of 5.75 tcf and a further significant potential for oil underlines the enormous potential of the Ruvuma PSA. When taken together with the vast reserves discovered to date offshore and the favourable operating cost environment of the onshore this represents a very valuable resource. Existing nearby infrastructure and the planned Mtwara to Dar es Salaam pipeline further enhance the commercial value of this acreage.

On the basis of the recent gas flow test results at Ntorya-1 and the over 1 tcf potential at Ntorya and the other prospects reported by ISIS; Solo will now be actively seeking an additional partner to participate in the next phase of exploration and development in the PSA. This is a very exciting time for Solo and we expect to have further positive news through the summer.'

Subscribe to:

Posts (Atom)